Nutritional Compositions and Sensitivity Analysis of Poultry Feed Mills in Bangladesh through Experimental Economics Approach-Juniper Publishers

Journal of Agriculture Research- Juniper Publishers

This research aimed at analyzing of nutritional

compositions and resource use efficiency of poultry feeds covering

Dhaka, Gazipur, Narsingdi, Kishoreganj and Mymensingh districts in

Bangladesh. A total of 30 feed mills which categorized as high, medium

and low quality on the basis of feed conversion ratio were selected

purposively. The feed sample were collected during March 2013 to March

2014 and analysis by using AOAC, 2000 methods and KII. It is evident

that a compound broiler feed of different feed manufacturers has

differed between analytical value (AV) means laboratory test result and

MV of various nutritional composition of ME value (energy). There is

much difference in CP content which was lower than requirements and ME

content was higher than requirements. The analytical value of EE (ether

extract) was higher than manufacturer value which influence on human

health. The results of sensitivity analyses clearly indicate that

poultry feed mills were price sensitive.

Keywords: Broiler production; Poultry feeds; Nutritional compositions; Financial profitability; Sensitivity analysis

Abbreviations:

AV; Analytical Value; EE: Ether Extract; FCR: Feed Conversion Ratio;

BCR: Benefit-Cost Ratio; NPV: Net Present Value; IRR: Internal Rate of

Return

Introduction

Livestock is playing an important role in the

national economy by contributing significantly to agriculture and to the

gross national product of Bangladesh [1-5]. Furthermore, it plays a

pivotal role in the rural socioeconomic system as maximum households are

directly involved in livestock sub-sector. Poultry industry is one of

the major among livestock sub-sectors that committed to supply cheap

sources of good quality nutritious animal protein to the nation in terms

of meat and eggs [1]. Total investment in poultry industry was Tk. 150

billion with an annual turnover of Tk. 200 to 250 billion [3]. Poultry

meat production was 30.21 lac tons and egg production 67542.80 lac in

2013/14 [6]. Poultry plays a pivotal role in bridging the protein gap of

animal origin in Bangladesh [7]. The poultry industry in Bangladesh

plays a crucial

role in economic growth and simultaneously creates numerous employment

opportunities for more than 6 million people [3]. Among animal number in

Bangladesh, poultry population was the highest in 2011-2012, it was

reaches 2329.9 lac in 2005-06 to 2932.4 lac in 2012-13 [8]. Chowdhury

[3] pointed out that the per capita consumption of all meat is 14.67kg

and egg is 31 numbers as against the requirements of 56kg meat and 365

eggs, respectively. The per capita poultry meat availability is

approximately one-fifth of the consumed meat (3kg) which needs to be

increased more than double to satisfy the current demand of 7.67kg while

that of egg more than three times to meet the per capita minimum

requirement of 102 eggs [2,4,9]. The trends of milk, meat and eggs

productions were increasing significantly from 2005-06 to 2012-13 [6].

Poultry feed mill industry as an agribusiness enterprise is

comparatively new in Bangladesh [9-12]. Total feed business,

especially, the business of concentrates was controlled by some

feed traders. Bangladesh is a feed deficit country [13]. At present

there are about 250 registered feed mills in Bangladesh. These

feed mills are not produced sufficient amounts of feed [4]. There

is a general agreement that low poultry production in Bangladesh

is mainly due to lack of nutritious feed and high price of poultry

staffs. The major feed additives are: toxin binder, mold inhibitor,

enzymes, synthetic amino acids and vitamins, feed premixes,

vitamin-mineral premixes, trace minerals, organic acids,

probiotics, salmonella killer, antibiotic for therapeutic use through

feeds (antibiotic as growth promoter is strictly prohibited to use

in the feed according to Feed Act 2010). Most of the feed additives

have been imported by the health companies and feed millers. The

major feed ingredients have been imported by the commercial

feed millers. The major feed ingredients are: meat and bone meal,

fish meal, protein concentrates, fish meal, soybean meal where

around 50% is locally produced [4].

Though, due to the government’s initiatives, supply situation

of feed has improved slightly, but still supply is very much

inadequate in relation to high increasing demand. The expansion

of commercial feed industry in Bangladesh can possible to

fulfill more than 80% of the total compound feed requirements.

Considering the existing growth rate of poultry, cattle and

aquaculture, the estimated annual compound feed requirement

would be 10.60 million MT in 2020-21 [4]. Therefore, according to

the estimation of their existing production capacity, it is revealed

that compound feed production will meet only 26.11% of the total

requirement in 2020-21 [13]. Hence, it indicates the potential of

compound feed production in the country in future.

Moreover, the poultry farmers are suffering severely from

the lack of security of their farms and investment of Bangladesh

[14]. Every year, thousands of farms are collapsing due to bird

flu outbreak and many for their incapability to buy high priced

poultry ingredients and absorb losses from market price fall [14].

In addition, feed intake accounts for approximately 65-70 percent

of the total cost of a farm. The poultry feed consumption was

around 18.36 lac MT in 2015 [5]. The most significant constraint

in the development of livestock sub-sector is the acute shortage

of balanced feed, which has been discussed earlier. In recent past,

many small-scale dairy and poultry farms were established in the

country, but 20 to 25 percent of dairy farms and 25 to 30 per of

poultry farms dropped out in their infant stage. Thus, by ensuring

the supply of quality feed for livestock sub-sector, the feed mill

industry is enhancing the whole economy significantly through its

forward linkage effect.

As the quality of feed is one of the determinant factors in

successful poultry farming, the present research was taken to

evaluate the quality of compound broiler feeds manufactured by

different feed manufacturers. This quality assessment of feeds had

been focused on several tests from initial observation on receipt,

quantitative analysis. This study is a modest effort undertaken

to examine the cost-effective supply chain of raw materials

and supply of poultry feed. The overall goal of this research is

to analysis the nutritional compositions of poultry feeds and

return over investment considering sensitivity analysis of broiler

production in Bangladesh and policy implications for the future

research. The specific objectives are as follows:

a. The nutritional composition determined by using the

method of AOAC [15].

b. The nutritional value obtained from AOAC was compared

with written in company supplying over the bags.

c. The objective function = Nutrient requirement was

maximized, and cost of the raw ingredient was minimized.

Materials and Methods

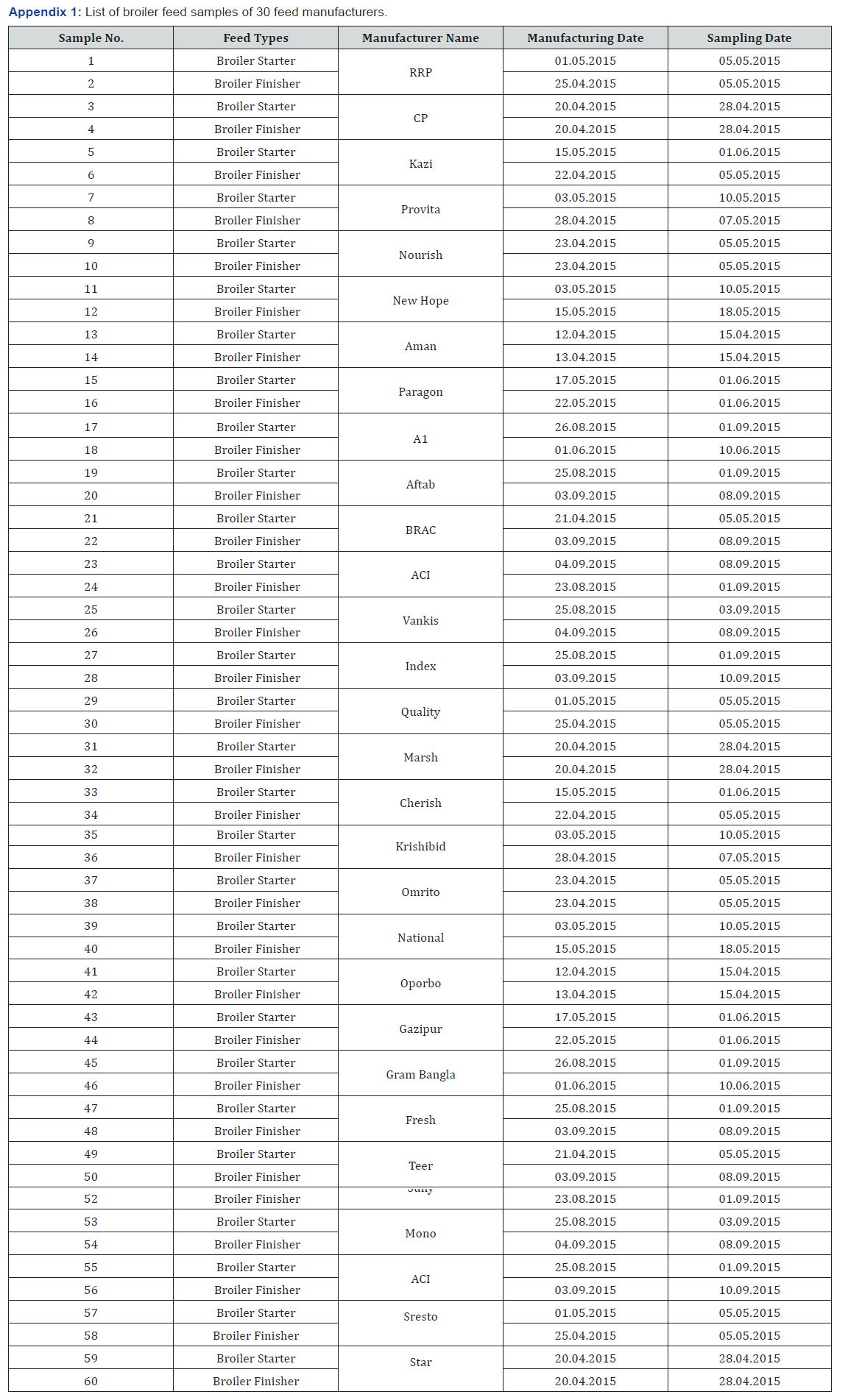

Sixty compound feed samples (30 broiler starter feeds and

30 broiler finisher feeds) of 30 different feed manufacturers

were collected proportionately from different locations of Dhaka,

Gazipur, Narsingdi, Mymensingh and Kishoreganj districts. The

field work conducted with feed miller, dealer, different sizes of

poultry farm owners and farmers. Table 1 showed that a multistage

stratified sampling was applied in this study. The feed mills

categorized on the basis of feed conversion ratio (FCR) that is high

quality feed mills (FCR; below 1.5 to below 1.6), medium quality

feed mills (FCR: 1.6 up to below 1.7) and low-quality feed mills

(FCR: 1.7 up). The selected commercial farms were categorized

by flock size small scale: < 1000 birds, medium scale: 1001-2000

birds and large scale: above 2000 birds. In conformity with the

objectives of the study, a structured questionnaire developed for

collecting relevant primary data from the poultry feed miller,

dealer and sub-dealer and farmers. The present study covered approximately from March 2013 to December 2014. It has been

found that CP (crude protein) and energy level written over the

bag but some time industries people are exploiting to farmers by

using unknown growth stimulating substances to increase for FCR

value:

a. The nutritional composition determined by using the

method of AOAC [15].

b. The nutritional value obtained from AOAC was compared

with written in company supplying over the bags.

c. The objective function = Nutrient requirement was

maximized, and cost of the raw ingredient was minimized.

The quality of compound feeds depends on the storage time

also. The broiler feed samples were collected within 10-15 days

after manufacturing of feeds at feed mills from broiler farmers.

After collection, feed samples were stored in refrigerator during

chemical analysis at animal nutrition laboratory. During the

collection of samples, feed bags and nutrient specification, expired

date on bags of different feed sample were carefully observed and

recorded.

Chemical analysis (proximate analysis)

The proximate components and energy content of the

collected feed samples were tested at Animal Nutrition Laboratory,

Bangladesh Agricultural University, Mymensingh (Appendix 1).

The chemical composition (dry matter, crude protein, crude fibre,

ether extract and ash) was determined by the procedure of AOAC

[15]. The ME content of the feed samples was determined by

using the values of crude fiber (CF), ether extract (EE), and ash

according to the method of Wiseman [16].

The formula is ME (Kcal / kg ) = 3951 + 54.4EE − 88.7CF − 40.8Ash

Where, CP is the crude protein (in percentage), EE is the ether

extract (in percentage) and Ash is the Ash (in percentage).

Return over investment analysis

To estimate the profitability of the feed mills and poultry

farms, project appraisal techniques such as BCR, NPV and IRR were

used. The financial analysis in this study was conducted from the

view point of owner of feed mill. Discounted measures of project

were used for financial analysis since undiscounted measures of

project worth is quite unable to take into consideration the timing

of benefits and costs through the project life. The discounted

measures are commonly used in agricultural project analysis.

These are:

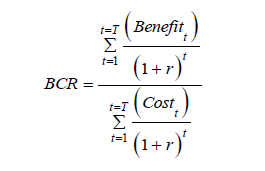

a. Benefit-Cost Ratio (BCR).

b. Net Present Value (NPV).

c. Internal Rate of Return (IRR)

The BCR is a relative measure which is used to compare

benefits per unit of cost. The NPV, on the other hand, is an

absolute measure which estimates the projects net present worth.

The IRR is also a relative measure which may be defined as the

average earning power of the money invested in a project over the

project life [17,18]. The formal mathematical statements of the

discounted measures of project worth suggested by Gittinger [19]

are as follows:

Benefit cost ratio (BCR): The benefit cost ratio (BCR) is a

relative measure which was used to compare benefit per unit of

cost. BCR estimated as a ratio gross returns and gross costs. The

formula of calculating BCR (undiscounted) is shown as below.

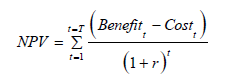

Net present value (NPV): NPV is the current value of all net

benefits associated with a project. NPV calculated by the following

equation:

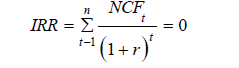

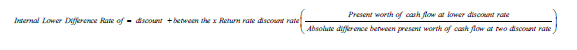

Internal rate of return (IRRI): IRR is the maximum interest

rate that could be paid for the project resources that would leave

enough money to cover investment costs and still allow society to

break even. IRR will be calculated by the following equation.

Where, B is the benefit in each year; Ct is the cost in each year;

NCFt is the net cash flow in each year f = 1,2…..n; n is the number of

years; i is the interest (discount) rate; and t for time.

For calculating the IRR, interpolation method is usually used.

The rule for interpolating the value of the internal rate of return

lying between discount rates at too high on the one side and at too

low on the other side. Thus,

Sensitivity analysis of poultry feeds production

Output and prices vary over time and subject to feed millers

and farmers’ risk. In the production cycle, certain prices, quantities

and costs may be highly variable resulting in a large effect on net

returns. At the same time, good output prices make poultry feed

millers and farmer’s profitable and less prices make looser. In case

of poultry feed raw materials price, output price is more sensitive.

So, sensitivity analyses have been done by assuming some

scenarios with varying input and output prices. By doing this, it

is possible to study the impact of changing feed raw materials

and feed price. Effects of sensitivity analysis of different quality

poultry feed mills considering followings situation.

a. Considering 5 percent decrease of feed price in market.

b. Considering 10 percent decrease of feed price in market.

c. Considering 5 percent increase of raw materials price in

market.

d. Considering 10 percent increase of raw materials price

in market.

Results and Discussion

Analytical and manufacturer value of broiler starter and finisher feed

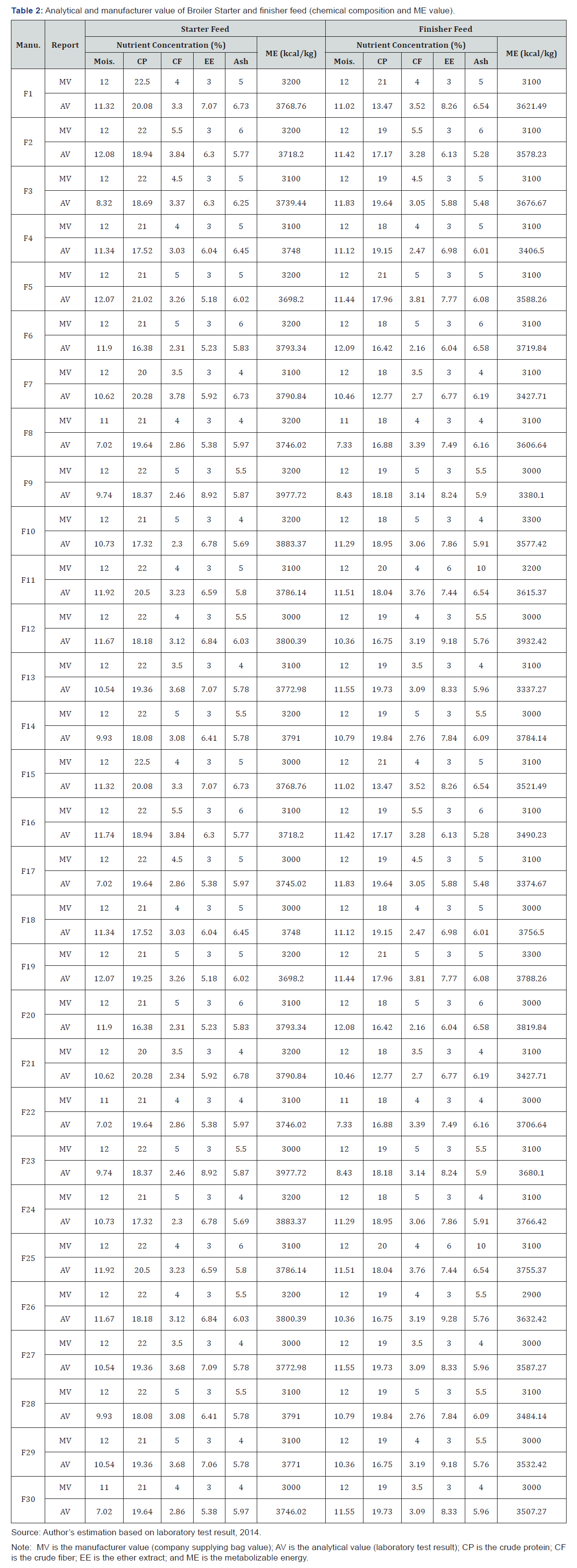

The results of analytical value (laboratory test result) and the

manufacturer value (different company supply feed bags labeling

there gives statement of the percentage of different components)

differed. The nutritional components of analytical value and

manufacturer value (the statement of feed company supplying

bag) of broiler starter feed samples differed except the moisture,

CF, and Ash content of feeds. The analytical value of broiler starter

feed of F1 manufacturer of moisture, CP, CF, Ash and EE were

11.32%, 20.08%, 3.30% 7.07% and 6.73% whereas manufacturer

values were 12%, 22.50%, 4.00%, 3.00% and 5.00%, respectively.

But ME value of this manufacturer MV and AV were 3200.00

and 3768.76 kcal per kg which indicates that analytical value

more than manufacturer values (Table 2). The analytical value of

broiler starter feed of F2 manufacturer of moisture, CP, CF, Ash

and EE were 12.08%, 18.94%, 3.84% 6.30% and 5.77% whereas

manufacturer values were 12%, 22.00%, 5.50%, 3.00% and 6.00%,

respectively. But ME value of this manufacturer MV and AV were

3200.00 and 3718.20 kcal per kg which indicates that analytical

value more than manufacturer values. The moisture content of F2

manufacturer is the height of these manufacturers. The analytical

value of broiler starter feed of F3 manufacturer of moisture, CP,

CF, Ash and EE were 8.32%, 18.69%, 3.37% 6.30% and 6.25%

whereas manufacturer values were 12%, 22.50%, 4.00%, 3.00%

and 5.00%, respectively. But ME value of this manufacturer MV

and AV were 3100.00 and 3739.44 kcal per kg which indicates

that analytical value more than manufacturer values. The similar

results also found for broiler starter feed of F5, F7, F21, F23 and

F27 manufacturer (Table 2).

In case of broiler finisher feed of F1 manufacturer

of moisture,

CP, CF, Ash and EE were 11.02%, 13.47%, 3.52% 8.26% and 6.54%

whereas manufacture values were 12.00%, 21.00%, 4.00%, 3.00%

and 5.00%, respectively. But ME value of this manufacturer MV

and AV were 3100.00 and 3621.49 kcal per kg which indicates that

analytical value more than manufacturer values. The analytical

value of broiler finisher feed of F6 manufacturer of moisture were

12.09% whereas manufacture values were 12.00% which is the

height value of these manufacturers. The analytical value of broiler

finisher feed of F14 manufacturer of crude protein was 19.84%

whereas manufacture values was 19.00% which is the height value

of these manufacturers. The analytical value of broiler finisher

feed of F26 manufacturer of ether extract was 9.28% whereas

manufacture values was 9.00% which is the height value of these

manufacturers. The analytical value of broiler finisher feed of F20

manufacturer of ME was 3819.84% whereas manufacture values

was 3000.00% which is the height value of these manufacturers

(Table 2).

Some research findings showed that there are several factors

can contribute to the variation in nutrient content including

genetic background of the plant, agricultural conditions where

the plant is grown (e.g. fertilization rates), stressors (e.g. drought,

extreme heat early frosts and diseases) and processing conditions

(e.g. mechanical extraction or chemical extraction). Other factors

like sampling and laboratory analysis could add up to the nutrient

variability [20,21].

Average chemical composition (analytical value and manufacturer value)

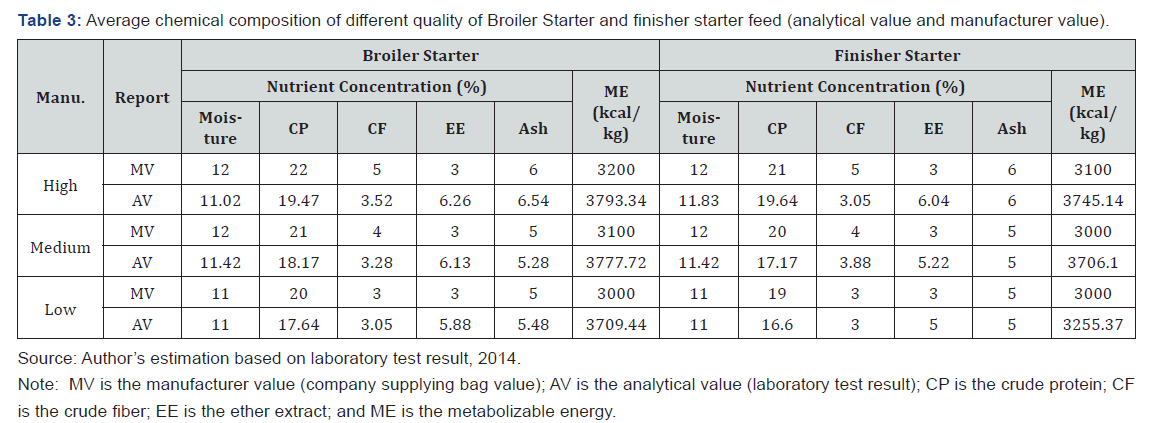

Average chemical composition of nutritional components

and ME value of the broiler feed samples of 30 different feed

manufacturers which were collected from feed company bags

and analyzed in the laboratory (Table 3). Table 3 shows that the

average analytical value of broiler starter feed of high-quality

manufacturer of moisture, CP, CF, Ash and EE were 11.32%,

19.47%, 3.52%, 6.26% and 6.54% whereas manufacturer values

were 12%, 22 %, 5.00%, 3.00% and 6.00%, respectively. But high

quality of manufacturer’s average ME value of MV and AV was

3200.00 and 3793.34 kcal per kg which indicates that analytical

value of ME is more than manufacturer values. The medium quality

manufacturer of their nutrient concentration of average analytical

values were 11.42%, 18.17%, 3.28%, 6.13% and 5.28% whereas

manufacturer values were 12%, 21 %, 4.00%, 3.00% and 5.00%,

respectively. But medium quality of manufacturer’s average ME

value of MV and AV was 3100.00 and 3777.72 kcal per kg which

indicates that analytical value of ME is more than manufacturer

values (Table 3). The low-quality manufacturer of their nutrient

concentration of average analytical values were 11.00%, 17.64%,

3.05%, 5.88% and 5.48% whereas manufacturer values were

11.00%, 20.00%, 3.00%, 3.00% and 5.00%, respectively. The low

quality of manufacturer’s average ME value of MV and AV were

3000.00 and 3709.44kcal per kg which indicates that analytical

value of ME value is more than manufacturer values.

In case of finisher feed the average analytical value of highquality

manufacturer of moisture, CP, CF, Ash and EE were 11.83%,

19.64%, 3.05%, 6.04% and 6.00% whereas manufacturer values

were 12.00%, 21.00 %, 5.00%, 3.00% and 6.00%, respectively.

But high quality of manufacturers’ average ME value of MV and

AV were 3100.00 and 3745.14kcal per kg which indicates that

analytical value of ME is more than manufacturer values. The

medium quality manufacturer of their nutrient concentration

of average analytical values were 11.42%, 17.17%, 3.08%,

5.22% and 5.00% whereas manufacturer values were 12.00%,

21.00%, 4.00%, 3.00% and 5.00%, respectively. But medium

quality of manufacturer’s average ME value of MV and AV were

3000.00 and 3706.10kcal per kg which indicates that analytical

value of ME is more than manufacturer values. The low-quality

manufacturer of their nutrient concentration of average analytical

values were 11.00%, 16.60%, 3.00%, 5.00% and 5.00% whereas

manufacturer values were 11.00%, 19.00%, 3.00%, 3.00% and

5.00%, respectively. The low quality of manufacturers’ average

ME value of MV and AV were 3000.00 and 3255.37kcal per kg

which indicates that analytical value of ME value is more than

manufacturer values (Table 3).

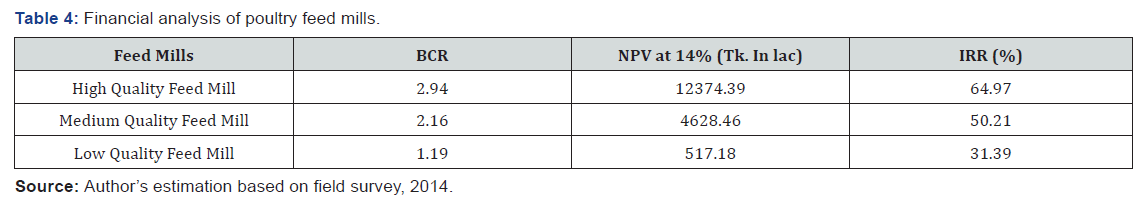

Profitability analysis of broiler production

After estimation all cost and returns it was easy to find out

financial returns of poultry feed mill. The result of benefit-cost

analysis is highly sensitive to the discount rate; the choice of

an appropriate discount rate, therefore, plays a vital role in the

appraisal of projects. The difficulties in estimating the opportunity

cost of capital are reflected by the study. The case becomes more

difficult in developing countries, because of various kinds of

imperfection and high distortion in the capital market. However,

the available literature suggests that in most developing countries,

the opportunity cost of capital varies between 8 to 15 percent.

According to the manager of the Sonali Bank of Mymensingh

branch, the lending rate of agriculture (production) loan is 14

percent. Thus, a 14 percent discount rate has been chosen for the

appraisal poultry feed mill.

Before proceeding to the final results, it is worthwhile to

recapitulate some salient features of the selected discounting

measures i.e., Benefit Cost Ratio (BCR), Net Present Value (NPV)

and Internal Rate of Return (IRR). The BCR is a relative measure

which is used to compare benefits per unit of cost. The NPV

criterion, on the other hand, is an absolute, not a relative measure

may have a smaller NPV than a large marginally acceptable project.

As long as both have a positive NPV, this is not really a problem

for the selection of a project. The IRR is not affected by the rate

of discount, while the NPV may change as a result of using a

different discount rate [22,23]. It is argued [24] that the ranking of

projects under the IRR criterion may also differ in the case where

net benefits vary overtime, even though all projects may have the

same life time. Nonetheless, all projects having IRR above the

opportunity cost of capital can be accepted. The summary results

of financial analysis of thirty poultry feed mill are presented in

Table 4 shows that BCR was 2.94, 2.16 and 1.9, respectively a high,

medium and low-quality feed mill which indicates the benefit

cost ratio of high-quality feed was better than medium and lowquality

feed. Considering 20 years’ time period and 14 percent

discount rate, the NPVs from poultry feed mill were also positive.

The average NPV of high, medium and low-quality feed mill was

also positive. The NPV of high, medium and low-quality feed mill

were Tk. 12374.39 lack, Tk. 4628.46 lack and Tk. 517.18 lack,

respectively which indicates the net present values of high-quality

feed mill was more than medium and low-quality feed (Table 4).

The positive NPVs indicate that poultry feed mill are

considered to be financially sound and the project said financially

viable because average IRR of high quality feed mill and low quality

feed mill. And IRR of high, medium and low-quality feed mills were

64.97%, 50.21% and 31.39%, respectively which greater than the

normal bank rate also indicates the internal rate of return of highquality

feed mill was better than medium and low quality feed.

That means it support that investment on high quality poultry

feed mill is highly profitable and economically viable. In view of

these circumstances, the financial analyses showed that poultry

feed mills were highly profitable from the view point of individual

investments. This research is also supported by some research like

feed costs typically represent the highest cost item in smallholder

production systems, implying that both quantity and quality of

feed have a significant effect in determining profitability [25,26].

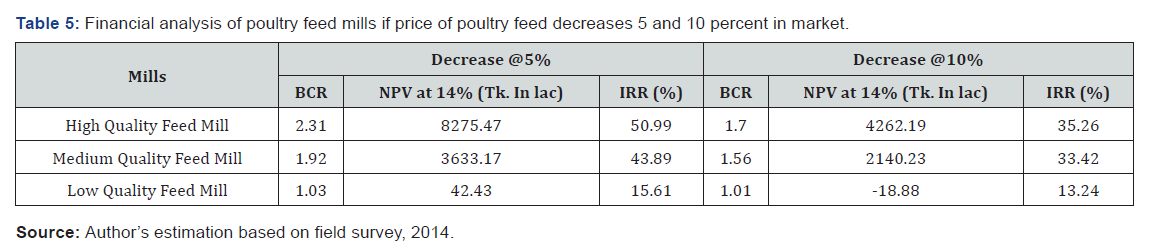

Sensitivity analysis of different quality poultry feed mills

Considering decrease in 5 and 10 percent poultry feed:

The evaluation of financial analysis as stated in Table 5 has been

done on the basis of certain assumptions as stated earlier. It

was assumed that the prices of all cost items as well as flow of

income would remain constant during the farm’s life. This short

of assumptions may turn out to be unrealistic in an uncertain

world. The result of sensitivity analysis shows how the investment

decision changes with the changes in the value of any variable in

the discounted cash flow analysis. The profitability of poultry feed

mill may be expected to be sensitive to price and yield uncertainty

which effects on gross benefits of the feed mill. Even the mills

themselves may not perform in the way expected. Many authors’

(e.g. [22,23]) also argue that the problem of uncertainty is another

knotty problem to which there is no tidy solution. A great deal

will inevitably depend upon the judgment of those making the

decision. Only one vital factor such as price of feed decrease to

the market is considered in this study for the sensitivity analysis.

The aim of this section is to analyze what happens to profitability

under the changed circumstances.

It is evident from financial analysis; the poultry

feed mills were

making high profits. Sensitivity analysis was conducted based on

the assumptions that all benefits and investment of capital costs

would happen in profitability of the feed mills; if price of poultry

feed decrease 5 percent or 10 percent, respectively and if price

of raw materials increase 5 percent or 10 percent, respectively

(Table 5). In case of 5 percent decrease of feed price in market

shows that BCR was 2.31, 1.92 and 1.03 respectively a high,

medium and low-quality feed mill which indicates the benefit cost

ratio of high-quality feed was better than medium and low-quality feed.

Considering 20 years’ time period and 14 percent discount

rate, the NPVs from poultry feed mill were also positive. The

average NPV of high, medium and low-quality feed mills was also

positive. The NPV of high, medium and low-quality feed mill were

Tk. 8275.47 lack, Tk. 3633.17 lack and Tk. 42.43 lack respectively

which indicates the net present values of high-quality feed mill

was more than medium and low-quality feed. The positive NPVs

indicate that poultry feed mills are considered to be financially

sound and the project are said financially viable because average

IRR of high, medium and low-quality feed mill. And IRR of high,

medium and low-quality feed mills were 50.99%, 43.89% and

15.61%, respectively that is higher than the normal bank rate

(Table 5). In view of these circumstances, the sensitivity analysis

showed that poultry feed mills were highly sensitive. This implies

that if the price of poultry feed price decrease at 5 percent in

market then poultry feed mill could run their business but some

mills were making loss and reluctant to operate feed mill.

Sensitivity analysis has been done taking into account 10

percent decrease of feed price in market. Summary results of

these analyses are presented in Table 5 shows that benefit cost

ratio (BCR) was 2.31, 1.92 and 1.03, respectively a high, medium

and low-quality feed mill which indicates the benefit cost ratio of

high-quality feed was better than medium and low quality feed.

The average NPV of high and medium quality feed mills was also

positive but low-quality feed mill was negative. The NPV of high,

medium and low-quality feed mills were Tk. 4262.19 lack, Tk.

2140.23 lack and Tk. -18.88 lack, respectively which indicates the

net present values of high-quality feed mill was more than medium

and low-quality feed. The positive NPVs indicate that poultry feed

mills are considered to be financially sound and the project are

said financially viable because average IRR of high and medium

quality feed mill but low-quality feed mills financially was not

viable. And IRR of high, medium and low-quality feed mills were

35.26%, 33.42% and 13.24%, respectively that is higher than the

normal bank rate. In view of these circumstances, the sensitivity

analyses showed that poultry feed mills were highly sensitive.

This implies that if the price of poultry feed price decrease

at 10 percent in market then poultry feed mill could run their

business but some mills were making loss and reluctant to

operate feed mill that means if price fall 10 percent then average

performance of poultry feed mill for both categorize would be in

loosing condition. Though some high-quality feed mills could able

to incur bank rate but they also not interested to continue their

business due to very low return from business. On the other hand

low quality feed mill stopped producing feed because average BCR

of poultry feed mill were less than unity, NPV was negative and

IRR was undetermined.

Considering decrease in 5 and 10 percent of raw materials:

Sensitivity analysis has been done taking into account 6 percent

increase of raw materials price in market. Summary results of

these analyses are presented in Table 6 shows that benefit cost

ratio (BCR) was 2.33, 1.94 and 1.12, respectively a high, medium

and low-quality feed mill which indicates the benefit cost ratio of

high quality feed was better than medium and low quality feed.

The average NPV of high, medium and low-quality feed mills was

positive. The NPV of high, medium and low-quality feed mill were

Tk. 8393.81 lack, Tk. 3695.32 lack and Tk. 294 lack, respectively

which indicates the net present values of high-quality feed mill

was more than medium and low quality feed.

The positive NPVs indicate that poultry feed mills are

considered to be financially sound and the project are said

financially viable because average IRR of high, medium and lowquality

feed mills financially was viable. And IRR of high, medium

and low-quality feed mills were 51.42%, 44.30% and 24.45%

respectively that is higher than the normal bank rate. In view of

these circumstances, the sensitivity analyses showed that poultry

feed mills were highly sensitive. This implies that if the price of

raw materials was increased at 5 percent in market then poultry

feed mill could run their business but some mills were making

less benefit and reluctant to operate feed mill that means if price

increased 5 percent then average performance of poultry feed mill

for both categorize would be in loosing condition. Though some

high-quality feed mills could able to incur bank rate but they also

not interested to continue their business due to very low return

from business.

Sensitivity analysis has been done taking into

account 5

percent increase of raw materials price in market. Summary

results of these analyses are presented in Table 6 shows that

benefit cost ratio (BCR) was 2.06, 1.72 and .99 respectively a high,

medium and low-quality feed mill which indicates the benefit

cost ratio of high-quality feed was better than medium and lowquality

feed. The average NPV of high, medium and low-quality

feed mills was positive. The NPV of high, medium and low-quality

feed mill were Tk. 6645.57 lack, Tk. 2786.62 lack and Tk. -81.99

lack respectively which indicates the net present values of highquality

feed mill was more than medium but low-quality feed was

negative (Table 6). The positive NPVs indicate that poultry feed mills

are considered to be financially sound and the project are

said financially viable because average IRR of high and medium

financially was viable and sound but low-quality feed mills was not

viable. And IRR of high, medium and low-quality feed mills were

44.90%, 38.13% and 12.70% respectively that is higher than the

normal bank rate. In view of these circumstances, the sensitivity

analyses showed that poultry feed mills were highly sensitive.

This implies that if the price of raw materials was increased at 10

percent in market then poultry feed mill could run their business

but some mills were making less benefit and reluctant to operate

feed mill that means if price increased 10 percent then average

performance of poultry feed mill for both categorize would be in

loosing condition. Though some high-quality feed mills could able

to incur bank rate but they also not interested to continue their

business due to very low return from business. On the other hand

low quality feed mill stopped producing feed because average BCR

of poultry feed mill were less than unity, NPV was negative and

IRR was undetermined.

Conclusion

It is clear that compound broiler feeds of different feed

manufacturers has differed between analytical value and

manufacturer value of various nutritional composition of

metabolizable energy value. There is much difference in crude

protein content and metabolizable energy content. The crude

protein was lower than requirements and metabolizable energy

was higher than requirements. The analytical value of EE was

higher than manufacturer value. Further research is needed to dig

down the limit of lowering the protein and increasing the ME value

of broiler feeds of manufacturers. Because, the analytical value

of EE was higher than manufacturer value which has influence

of health hazard. The findings of the study the benefit from high

quality feed are higher than medium and low-quality feed. It

is evident that the high-quality poultry feed mills were highly

profitable comparatively medium and low-quality feed mills

considering the real condition. The results of sensitivity analyses

clearly indicate that poultry feed mills were price sensitive. If price

fall in the market, then they can marginally sustain in the market

but if it is more than 5 percent then they will reluctant to operate

poultry feed mill. So, we can say, profitability of poultry feed mills

appears to be negatively correlated with decrease of poultry feed

price in market. If price of raw materials price were increased in

the market, then they can marginally sustain in the market but

if raw materials price were increased 10 percent then average

performance of poultry feed mill for both categorize would be in

loosing condition. Though some high-quality feed mills could able

to incur bank rate but they also not interested to continue their

business due to very low return from business. On the other hand,

low quality feed mill stopped producing feed because average BCR

of poultry feed mill was less than unity.

Comments

Post a Comment